EU VAT-Compliant Invoice Generator - Create VAT Invoices from CSV

Generate accountant-ready EU VAT invoices from CSV files. Support for reverse charge, cross-border SaaS invoicing, and full EU compliance. Perfect for e-Residency businesses and EU digital services.

Our EU invoice from CSV generator helps you create VAT invoice from CSV files with full compliance. Whether you need VAT invoice from CSV for cross-border SaaS or EU SaaS invoice CSV processing, our tool generates accountant-ready invoices with proper reverse charge handling, VAT calculations, and EU formatting standards.

Stop Wrestling with EU VAT Invoice Requirements

❌ Your Accountant Keeps Asking for "Proper" Invoices

They need VAT numbers, reverse charge notation, and EU-compliant formatting. Manual invoice creation takes hours and errors cause compliance headaches.

❌ Reverse Charge Rules Are Confusing

B2B cross-border transactions, VAT number validation, when to apply 0% VAT. One mistake and your accountant sends invoices back for correction.

❌ E-Residency Invoicing Feels Overwhelming

Estonia requires proper VAT handling, EU compliance, and specific formatting. You're a founder, not an accountant.

Why Use Our EU VAT Invoice Generator?

Automatic Reverse Charge Handling

Upload CSV with customer VAT numbers, and we automatically apply reverse charge for B2B EU transactions. Proper notation included on invoices.

Accountant-Ready Format

Generate VAT invoice from CSV in the exact format your accountant needs. All required VAT fields, proper calculations, EU-compliant structure.

Built by Estonia e-Resident for e-Residents

Created by a founder who understands EU VAT compliance, e-Residency requirements, and cross-border SaaS invoicing challenges. Estonia e-Resident? Check out our dedicated e-Residency invoice generator with OÜ-specific features.

How to Create EU VAT Invoice from CSV in 4 Steps

Export Sales Data as CSV

Export transaction data from Stripe, ThriveCart, or your payment processor. Include customer VAT numbers and billing countries in your CSV.

Upload CSV & Map VAT Fields

Upload CSV file and map columns to invoice fields including VAT number, VAT rate, and net amount. System validates VAT numbers automatically.

Enter Your Company VAT Details

Add your company VAT number, registration details, and business address once. System stores for future invoice batches.

Generate VAT-Compliant Invoices

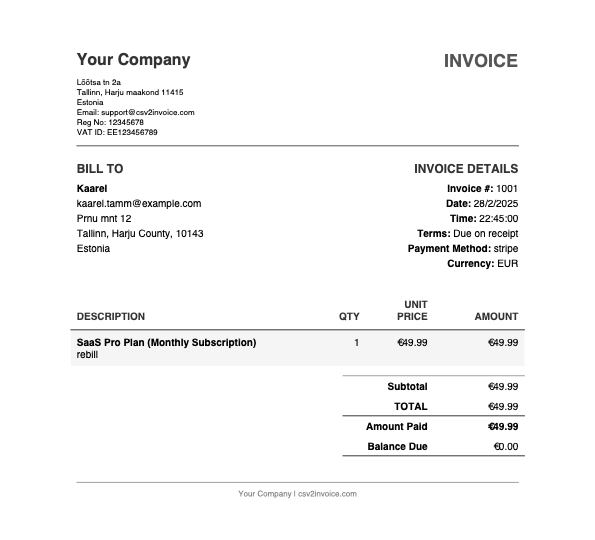

Create EU invoice from CSV with proper VAT calculations, reverse charge notation, and accountant-ready format. Download as professional PDFs.

Watch: Create EU VAT-Compliant Invoices from CSV

See how easy it is to generate VAT invoices with reverse charge, proper formatting, and EU compliance.

EU VAT Invoice Generator Features

Reverse Charge Automation

Automatically apply reverse charge mechanism for B2B EU transactions. System detects valid VAT numbers and adds required notation.

VAT Number Validation

Built-in VAT number format validation for all EU member states. Catch errors before generating invoices.

Multiple VAT Rates

Support for standard rates, reduced rates, zero-rated, and exempt transactions. Different rates per line item if needed.

EU Formatting Standards

Invoices formatted according to EU regulations with all required fields: VAT numbers, tax point date, breakdown of amounts.

Cross-Border SaaS Ready

Handle digital services across EU borders with proper place-of-supply rules and reverse charge for B2B transactions.

Accountant-Approved Format

Generate invoices your accountant will love. Proper structure, all required VAT details, ready for accounting software import.

Simple, Transparent Pricing

Unlimited EU VAT invoices. No per-invoice fees, no hidden charges.

Monthly

Perfect for trying EU invoicing

- Unlimited VAT Invoices

- Reverse Charge Support

- EU Compliance

- VAT Number Validation

- PDF Export

- 7 Days Free Trial

- Email Support

Yearly

Best for regular EU invoicing (~€5/month)

- Unlimited VAT Invoices

- Reverse Charge Support

- EU Compliance

- VAT Number Validation

- PDF Export

- 7 Days Free Trial

- Priority Support

Perfect for EU Businesses & e-Residents

SaaS Companies with EU Customers

Generate VAT invoice from CSV for cross-border digital services. Automatic reverse charge for B2B, proper VAT rates for B2C transactions.

Estonia e-Residency Businesses

Create EU invoice from CSV that meets Estonia accounting requirements. Built by an e-Resident who understands the compliance challenges.

Accountants & Bookkeepers

Generate client invoices with proper VAT handling. All required fields for accounting software, proper EU formatting, reverse charge notation.

Built by an Estonia e-Resident for e-Residents

I became an Estonia e-Resident to run my SaaS business in the EU. The first month, my accountant sent back my invoices: "These don't have proper VAT formatting." "Where's the reverse charge notation?" "The VAT calculation is wrong."

I was spending hours manually creating invoices, researching EU VAT rules, and still getting it wrong. So I built this tool to generate VAT-compliant invoices from my Stripe CSV exports.

Now my accountant is happy, my invoices are EU-compliant, and I spend 5 minutes per month instead of 5 hours on invoicing. If you're an e-Resident or EU business struggling with VAT invoices, this tool is for you.

— Built with ❤️ from Estonia

EU VAT Invoice Generator FAQs

Start Generating EU VAT-Compliant Invoices Today

Join EU SaaS founders and e-Residents who create VAT invoice from CSV with proper compliance. Stop worrying about reverse charge rules and accountant rejections.

Try Free - Generate VAT Invoices Now